Syria has been persistently in the news with the Sunni advancing fast toward the capital. Some media claim the Sunni have received advanced military technology that is decimating the cavalry divisions of Bashar al-Assad's regime. The fall of Damascus appears now a matter of time. The question then is: where will the Sunni turn to next? Will they pursue the western front towards Lebanon, or will they focus on the eastern front in Iraq? Irrespective of the outcome, the Sunni are already regaining the initiative in Iraq, once again attesting to their superior logistics and warfare practice.

ReutersThe raging wars between Sunni and Shiites in Near and Middle East have not disturbed petroleum markets thus far. Drilling activity is receding all around world, indicating that 67 $/b is an insufficient price for the large part of the resources currently available. The few exceptions to this contraction are precisely in the Middle East.

Iraqi refinery may be destroyed in battle to save it

13-05-2015

Islamic State militants have dug trenches around natural gas and hydrogen tanks at Iraq's largest refinery, raising the stakes in a battle where the price of victory may be the refinery itself.

The Baiji refinery remains contested despite more than 300 coalition air strikes in the vicinity since the Islamist insurgents overran the area last June.

The militants launched their fiercest attack on the installation last month and now control large parts of the complex in which 200 Iraqi security forces are trapped.

The Pentagon last week said the outcome of the battle -- in which Iraqi security forces backed by coalition warplanes are fighting to retake the refinery from Islamic State militants -- could not be predicted but warned it was going in "the wrong direction".

PeakOilBarrelThe petroleum industry bust is perceivable in many different ways. The tar sands exploited in Canada require large numbers of large machinery, that with the downturn are now flooding the market. "Reality has yet to set in", however - another indication that the worst is still to come in this downturn.

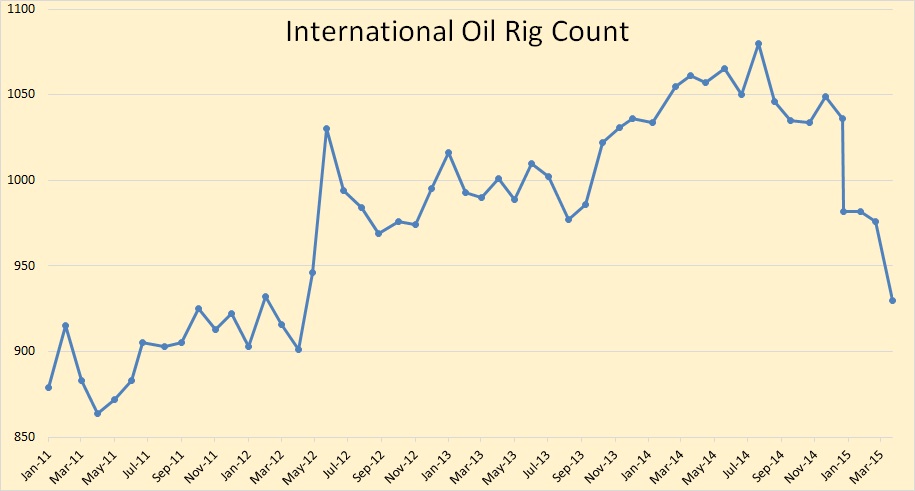

International Oil Rig Counts

Ron Patterson, 09-05-2015

The International Rig Count has fallen by 150 rigs, from 1,080 in July 2014 to 930 in April 2015. This count does not include the USA, Canada or any of the FSU countries.

Financial PostIn the US the downturn is impacting the petroleum industry all across the board, with two thirds of the companies that already reported first quarter earnings coming on the red. A quick lift of the petroleum price is required to avoid some sort of meltdown.

Alberta equipment auctioneers are flooded with asset sales ― and fetching record prices

Geoffrey Morgan, 08-05-2015

[...] By the time the auction last week was over, a record $215 million worth of equipment had been sold, thanks in large part to the slowdown in oil and gas activity across the province. Energy companies have pulled back hard on capital spending – data from ARC Financial Corp. shows Canadian oil producers have announced a reduction of $16 billion in capital spending this year compared with 2014, with more likely on the way – due to the collapse in oil prices since last summer, and the ripple effect is being felt by a wide range of companies across Alberta, including Richardson’s road construction and gravel-crushing businesses. As the construction, drilling, trucking, oilfield services, and other businesses dry up, they come here, to Ritchie Bros Auctioneers, to sell off their machinery.

But this auction being held near the end of April is no fire sale. Richardson, the president and co-owner of Richardson Bros (Olds) Ltd., said he sees equipment selling for what it would “in a normal, buoyant economy” — even though Alberta’s economy hasn’t been buoyant since the price of oil collapsed in June 2014. Maybe, he wonders, reality has yet to set in.

“One of these days, if oil stays $60 and below, there’s going to be a slaughter,” he said, predicting that used industrial equipment prices would eventually fall along with commodity prices. “I thought it would be the first sale. Then I thought it would be the second sale and it still hasn’t occurred.”

The Growth Stock WireEven the jewel of the US industry crown is not safe from under-priced markets. This bust is in reality an accelerator to a secular trend: western petroleum companies are loosing access to profitable resources (i.e. those yielding higher EROEI). Apart from lunatic endeavours to inhospitable environments such as the Arctic, meaningful exploratory activity has nearly ceased.

Why It's Time to Be Cautious in the Oil and Gas Sector

Matt Badiali, 08-05-2015

The bad news in the oil and gas sector keeps coming...

Oil and gas giants like SM Energy, Apache, and Hess are starting to report their 2015 first-quarter earnings.

So far, the results prove even the big names in the sector are running into trouble...

[...] According to Bloomberg, 47 large independent oil and gas producers with market caps of more than $1 billion have reported first-quarter earnings so far.

Around 70% of these companies saw a decline in operating income (earnings before interest and taxes) from the fourth quarter of 2014 to the first quarter of 2015. About 62% of them posted operating losses for the first quarter of 2015. In total, the group's operating loss increased by $18.1 billion.

The Daily ImpactChina was in April the world's largest petroleum importer, with the US still consumption plenty of its expensive "shale oil". This situation may be merely temporary, as geology and prices bring reality back to the US market.

Oil: A Fit of Peak

Tom Lewis, 07-05-2015

Arthur Berman is perhaps the most credible debunkers of oil hype on the planet because he is a highly qualified petroleum geologist and a longtime, top-tier employee of the oil industry. In a presentation early this year, he made an offhand remark in answer to a question about Exxon Mobil CEO Rex Tillerson. “Oh,” Berman responded, “Rex knows his company is in liquidation and he’s terrified his stockholders are going to find out.” I don’t know if anyone else heard a thunderclap at that moment. The discussion moved quickly onward, but I sat stunned (as I listened to the tape). It seemed to me I had just heard spoken aloud the essential truth of our industrial age: it’s in liquidation, and the people in charge are terrified we are going to find out.

Liquidation, also known as a going-out-of-business sale, is a stunning word to use about the oil industry, unless you think about it for a minute. A company in liquidation stops making or buying its product and keeps selling until its inventory is gone, then turns out the lights and locks the doors. Oil companies don’t make oil, they have to find it, and they aren’t finding any. What’s more, take a look at their capex (capital expenditures for exploration and development) numbers and you see that after a decade of increasingly frenzied and expensive searching for new oil fields, with ever-diminishing returns, the industry has virtually stopped looking. Which brings us once again to the shoals of peak oil.

International Business TimesRecently another technological hype brewed up around a "novel" method developed by Audi to synthesise diesel from water and CO2, which is essentially a variation on an old theme. Euan Mearns explains how little sense such idea makes thermodynamically. The catch here is: assuming an electricity cost of 0.075 €/kWh (reference German wind turbine) plus tax breaks and carbon permit sales, the final cost of this liquid fuel may well be within the range advertised by Audi.

China's Crude Oil Imports Surpass Those Of US In April

Avaneesh Pandey, 11-05-2015

Chinese crude oil imports surpassed those of the United States for the first time in April, making the Asian nation the world’s top importer of crude oil. According to a report by the Financial Times, the world’s second-largest economy purchased 7.4 million barrels of crude oil a day in April, topping U.S. imports of 7.2 million barrels a day.

“Being the world's biggest crude importer should give China more buying power. China's engagement in the Middle East will continue to change, and it will no longer be the minority player,” Philip Andrews-Speed, head of energy security research at the National University of Singapore, told Reuters.

The increased imports were in direct contrast with Chinese crude oil exports, which reportedly fell by 41 percent in April, possibly ending speculation that the country was running out of storage space. The Chinese government rarely releases data about its oil reserves.

Energy MattersWhile in Europe governments keep busy deterring renewable energies and promoting thermodynamic nonsenses, others grow sage. Brasil seems on the verge of becoming one more hot spot for the PV market.

The Thermodynamic and Economic Realities of Audi’s E Diesel

Euan Mearns, 13-05-2015

A couple of weeks ago Audi made an announcement claiming to have invented a process that manufactured diesel solely from water, carbon dioxide and renewable energy sources. This new sustainable diesel was christened e diesel. Former Oil Drum colleague Robert Rapier (RR) has already run some energy and cost numbers on the process to reveal it in its true colours. Robert I feel was rather conservative in his analysis. In this post I use Robert’s back of envelope calculations as a starting point to expose some of the harsh thermodynamic, economic and social realities.

In summary:

- Using European electricity prices, the energy cost of e diesel at the refinery gate would be of the order €1.8 litre – excluding manpower, capex, profit, distribution costs and taxes. Adding in the latter might easily take the price to €3 / litre, much higher than Audi’s estimate of €1 to 1.5 € per liter. This compares with a refinery gate price for FF diesel of the order €0.65 per liter. e diesel may cost 2.7 to 4.5 times as much as traditional diesel.

- The energy return on energy invested (ERoEI) for the process is at best 0.5. For every BTU of e diesel produced about 2 BTUs of electricity are consumed. E diesel is an energy sink or energy conversion where at least 50% of the energy is lost along the way.

- To convert Europe to run on e diesel would require a 12 fold increase in todays “new renewable” infrastructure and would result in a doubling of the energy consumed in the transport sector.

Clean TechnicaClosing a solar-sceptical article. At first the problem with PV was cost, but cost came down. Then the problem was EROEI, but it slowly went up. Out of options, the detractors of renewable technologies are now claiming it is a "bad" technology because it emits CO2. In 2014 world CO2 emissions declined, including in China, but this matters little to those focused on deterring PV. This article actually puts the EROEI of PV somewhere between 8:1 and 15:1, but CO2 seems to be far more important now.

Brazil Could Reach 2 GW Rooftop Solar By 2024 After Tax Is Dismissed

Joshua S Hill, 14-05-2015

Reported last week by various news agencies, the Brazilian government has ruled that local states no longer need to tax renewable power, which could allow the country to reach 2 GW of rooftop solar by 2024.

According to reports, Brazil’s government will lower profit participation contributions and social security taxes for solar equipment used by residential customers. Brazil’s Energy Minister Eduardo Braga announced the move on Wednesday of last week, adding that the country’s government will also ask states to reduce the goods flow tax on the energy generated by solar.

“The state of Sao Paulo endorsed our proposal and is leading a process that is a milestone for Brazilian solar generation,” Braga said in a speech to Congress. “Tax exemption will enable this source to be competitive,” though he apparently did not say how much the taxes might be reduced. The ICMS tax is said to average 20% to 30% of the value of renewable energy that homes and businesses return to the grid.

This kind logic perfectly shows the challenges we face today in the OECD to have a congruent energy policy. Sustainability immediately equates to CO2 and thermodynamics is happily thrown overboard. To develop a truly sustainable and resilient energy policy we might have to simply dump CO2 out of picture.

Low-tech MagazineEnjoy your weekend.

How Sustainable is PV Solar Power?

Kris De Decker

Solar photovoltaic (PV) systems generate "free" electricity from sunlight, but manufacturing them is an energy-intensive process.

It's generally assumed that it only takes a few years before solar panels have generated as much energy as it took to make them, resulting in very low greenhouse gas emissions compared to conventional grid electricity.

However, the studies upon which this assumption is based are written by a handful of researchers who arguably have a positive bias towards solar PV. A more critical analysis shows that the cumulative energy and CO2 balance of the industry is negative, meaning that solar PV has actually increased energy use and greenhouse gas emissions instead of lowering them.

About China as first importer, although probably true this time, it was already announced in October 2013 :

ReplyDeletehttp://www.bbc.com/news/business-24475934